Non-dilutive capital—which refers to capital a business owner receives without requiring them to give up equity—is a popular and growing form of alternative financing for Canadian startups and SMBs.

Debt capital markets have lagged behind equity markets as a viable financing instrument for startups and SMEs. Historically, lenders and providers have been few and far in between, with stringent requirements and extremely prohibitive credit boxes. In the past, startups have taken on unfavorable loan arrangements just to get off the ground; small businesses faced similar hurdles with regards to cash flow. Today, there’s a growing recognition that non-dilutive capital can be a mutually beneficial option for investors as well as startups/SMBs.

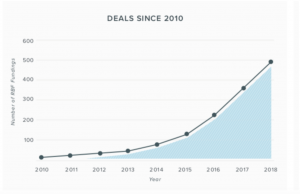

There are several types of non-dilutive funding that exist in the market; however, one of the most popular forms includes revenue-based financing (RBF). Revenue-based financing (RBF), also known as royalty-based financing, allows businesses to raise capital by way of investors receiving a percentage of the enterprise’s ongoing gross revenues in exchange for the money they invested. Due to the fact that investors do not generally take equity when it comes to RBF, there is little to no ownership dilution to early equity investors. In addition, RBF allows entrepreneurs to hit their growth targets without giving away equity shares and is growing in popularity, as the chart below demonstrates:

Source: Lighter Capital, The Rise of Revenue-Based Financing

As new players enter the market and incumbents adjust to remain competitive, there is a preponderance of capital waiting to support Canadian businesses—especially small businesses and startups. Over 40% of private credit managers are actively lending to companies with EBITDA of less than $25 million. With all these new options, sorting through the various funding sources and making the right decision on who to partner with becomes paramount. One company that allows SMEs and startups to scale quicker with easy to access non-dilutive capital is Jeeves Growth, a product from the corporate card and expense management system, Jeeves, that gives revenue-based financing solutions to companies worldwide, leveraging the existing Jeeves infrastructure to allow startups and SMEs to scale. William Lam, General Manager at Jeeves says, “We believe debt capital markets will play an increasingly important role in startup and fast-growing business funding.” With flexibility that was never possible before, financial instruments like Jeeves Growth provides founders and business owners with the capital to accelerate innovation and growth.”

Whether it’s for a startup in the tech space or a small e-commerce business, Canadian entrepreneurs have a variety of funding options to fuel their business growth. Non-dilutive capital can be leveraged as one form of alternative financing that gives founders more agency as they scale, and the ability to fundraise with stronger metrics in later equity fundraising.

To learn more about the various forms of private debt financing, keep an eye out for the CLA’s upcoming white paper, “Funding the Middle: A Report on the Mid-Market Landscape in Canada and Abroad.”