In the past, cash flow has been a considerable challenge for small to medium sized enterprises, which typically employ less than 500 people. SMEs are vital to the functioning of the Canadian economy, and contribute almost half the GDP generated in the private sector. These businesses are Canada’s largest employer, with over 8.4 million Canadians employed at over 1.2 million SMEs.

The specific needs of SMEs—including access to corporate cards—are often not met by big banks, who have historically considered their risk profiles not worth the investment. About 40% of credit applications from SMEs in Canada get rejected, and when banks do offer SMEs corporate cards, they frequently come with low credit limits or only after a personal guarantee. Furthermore, they can take a long time to process SME applications. All these factors lead many business owners to take out personal cards for company spending.

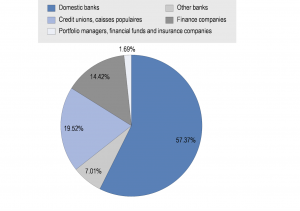

Despite these hindrances, a sizable portion of SMEs still receive their funding through big banks, as evidenced by this chart of debt financing by source of financing in Canada to small businesses:

Source: Statistics Canada, Survey of Suppliers of Business Financing 2018

Yet the obstacles to easy access to credit through institutional channels creates an opportunity for fintechs to step in and provide superior solutioning. Moreover, the pie is expanding; total lending to SMEs in Canada has increased in recent years.

The Role of Embedded Solutions

A variety of digital-first companies have stepped into the SME lending space in Canada. And because of the big pool of demand, these fintechs specifically for SMEs have generated significant investor attention; Float raised $30 million in a funding round in 2021, and Jeeves raised $57 million in a Series B funding, with its customer base doubling every 60 to 90 days. The influx of venture capital funding going to support these efforts has reached the highest levels of VC investment recorded in Canada since 2001.

Many of these digital solutions come with proprietary credit scoring methods enabled to analyse a vast array of alternative data. This allows for expedited, nuanced risk assessments. Several companies also offer expense cards, which reduces the pressures around cash flow.

One example of an innovative startup in this space is the spend management platform Caary Capital. Caary’s new corporate card expected to launch in Q1 2022, and the company uses alternative data and open banking tools to monitor risk profiles, and offers finance tools for expense management and accounting. Sabrina Pilbaur, CFO at Caary told PYMNTS, “We’re trying to build that relationship and be behind those SMEs in a very different way” by cultivating personalized relationships with small business owners.

Proprietary credit-scoring systems can help customize lines of credit for each client. William Lam, General Manager at Jeeves told the CLA, “many startups and fast-growing companies do not fit well with the traditional underwriting model where years of financial statements and a healthy business credit score are required.” Thus, Jeeves leverages multiple data sources and machine learning to underwrite. “This is one of the ways where we differentiate ourselves and provide value to not only our clients, but the Canadian economy,” Lam added.

Partnership with banks and embedded solutioning are not mutually exclusive, either; according to Dileep Thazhmon, CEO of Jeeves, “the banks that partner with us see us as providing access to an asset class they might not be able to finance directly — receivables financing for fast-growing companies.” Silicon Valley Bank, for example, has participated in funding rounds for several of these fintechs.

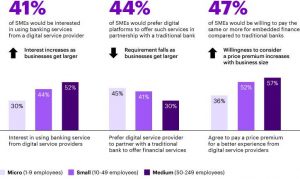

Still, digital service providers have caught the eye of many SMEs lately, who are starting to shift away from partnerships with traditional banks, especially for the custom features such as receipt capture and virtual issuance. Willingness to pay a premium for these services is demonstrated by almost half of SMEs surveyed below:

Source: Accenture

Fintech solutions can provide more than just a reasonable APR: they also fit into the SME’s existing expense management system. Additional features such as cash back and budget management are extra perks as well.

Opportunities Abound

Toronto-based Wave Financial has already entered the U.S. to provide business debit cards, plus services such as instant free deposits from customers to Wave accounts, invoicing, payments processing, and payroll services. Wave has 300,000 monthly active users in North America, and allows small businesses to speed up their cash flow through their invoicing and online payments platform.

Other opportunities for growth are abundant; in 2022, we’re likely to see even more international expansion, BNPL product integration and partnerships with traditional finance institutions. An analysis by Accenture predicts embedded banking solutions for SMEs could capture up to 26% of global SME banking revenue by 2025, and that the total market for embedded finance for SMEs could be worth up to $124 billion. It’s likely that as more and more Canadian business owners turn to these solutions, it’s Canadian end consumers who will ultimately benefit.

Digital solutions for SMEs have expanded from a niche segment to a full-fledged part of the lending space. In the form of both virtual and physical cards, a diverse set of fintech solutions can meet the needs of all SMEs today.