Canadian Alt Lending Sector Grows by 159%

Canada, the second largest market, generated $868 million. The report notes that Canada saw considerable growth, up by 159% from $335 million in 2016 to $868 million in 2017. The Canadian alternative finance market was driven primarily by alternative business funding, which accounted for 61% of the total.

The Cambridge Centre for Alternative Finance (CCAF) has published their annual report on alternative finance covering the Americas. According to Reaching New Heights: the 3rd Americas Alternative Finance Industry Report covering data for 2017, across the Americas alternative finance grew by 26% to reach $44.3 billion in 2017. The bulk of this amount was driven by the US accounting for 97% of the Americas market and $42.81 billion.

For this years report, 35 countries in the Americas were surveyed. This included survey submission from 234 unique platforms. In addition, external data was collated from 47 platforms. This represents an increase of 134% in platform coverage for the year.

In 2016, CCAF reported $35.2 billion for the year. The growth rate was approximately 23% from the prior year. Throughout the last five years (2013-2017) the average annual growth stands at 89%. Total volume over the last five years amounted to $124.5 billion. Of this amount, 35% came in 2017 alone.

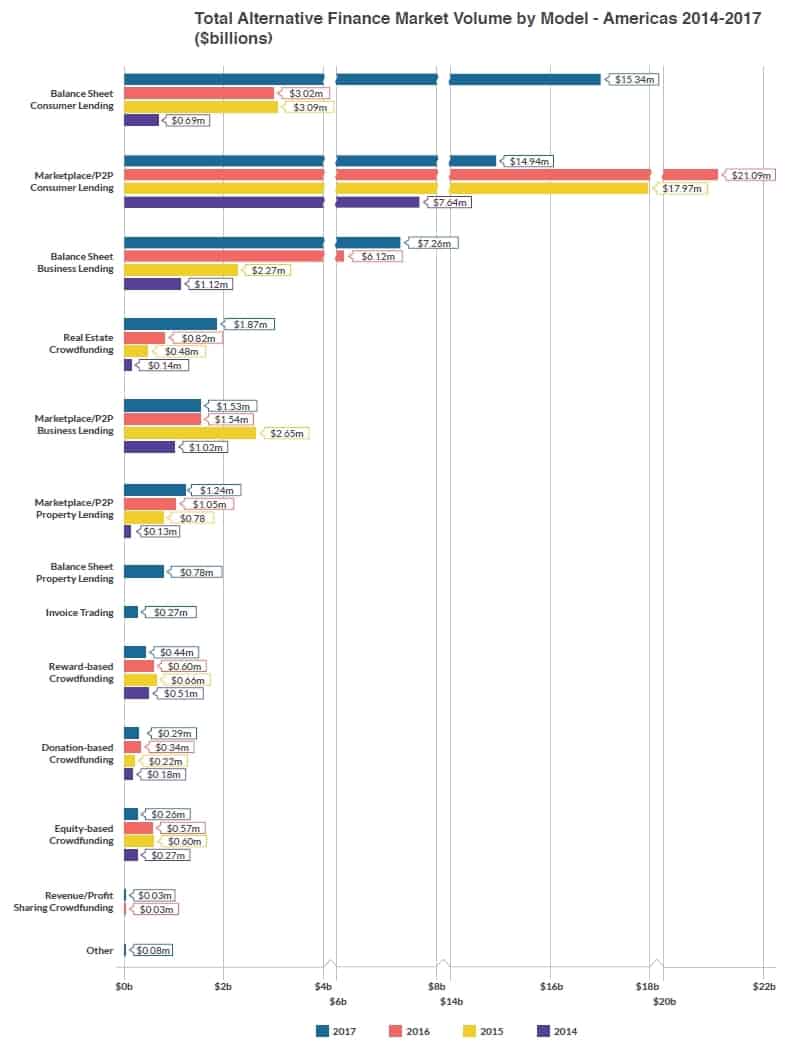

For the US, Consumer Lending was the key driver in the market. Balance Sheet Consumer Lending accounted for $15.2 billion (35.5% of market share) and Marketplace/P2P Consumer Lending accounting for $14.7 billion (34.3% of market share).

Not including the US, SME business financing was the clear market driver.

According to the report, 85% (or $566 million) of all alternative finance volumes across the region came from business financing. CCAF states this is particularly pronounced in Chile, where alternative business funding accounted for 27% of the overall Latin America / Caribbean (LAC) business funding market.

Some other data points provided by the CCAF Americas report include:

- The US is the second largest alternative finance market in the world as it trails China (dramatically). As shared in the CCAF Asia report, China hit US $358 billion in 2017 growing by 47% versus year prior.

- Real Estate Crowdfunding increased by 128% to $1.8 billion in 2017 from $821 million in 2016. The model accounted for 4.2% of the total market in 2017 and grew by 128% annually.

- Balance Sheet Consumer Lending accounted for $15.3 billion, up an impressive 409% from the $3.0 billion in 2016. The model accounted for 34.5% of the total market in 2017. This was the largest model across the region.

- Marketplace/P2P Business Lending registered $1.5 billion, slightly down 0.33% from the $1.5 billion in 2016.

- Marketplace/P2P Consumer Lending reached $14.9 billion, down 29% from the $21.1 billion in 2016. This model accounted for 33.6% of the total alternative finance market volume in 2017 in the Americas.

- Equity Crowdfunding accounted for just $260.9 million in 2017, down 54% from $569.5 million in 2016. This sector is stagnating

- Rewards platforms are included as well. As with the other parts of the world, this sector is in decline down by 26%

- The research identified 48 platforms that pivoted away from ‘orthodox’ alternative finance models or were no longer active.